Unlock a new passive income stream

On Public, you can invest in shares of royalties and potentially earn passive income from an asset class that typically performs independently from traditional markets.

Sign upExplore the AssetAs seen in

What are royalties?

Royalties are payments received for the use of intellectual property, like music. As an alternative asset class, royalties offer investors a unique passive income opportunity. While royalties, like all investments, carry some degree of risk, these assets typically have a low correlation with traditional markets and can provide long-term revenue streams, often extending beyond the artist's lifetime.

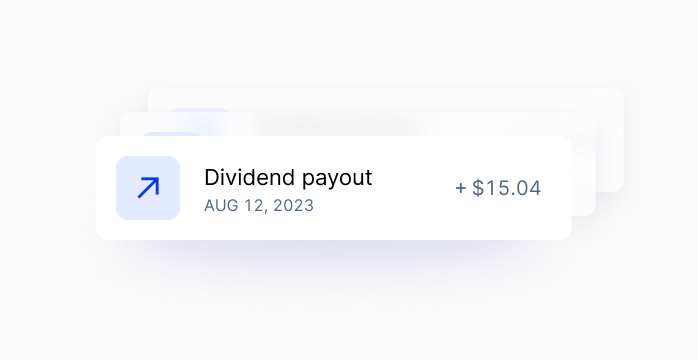

Earn passive income

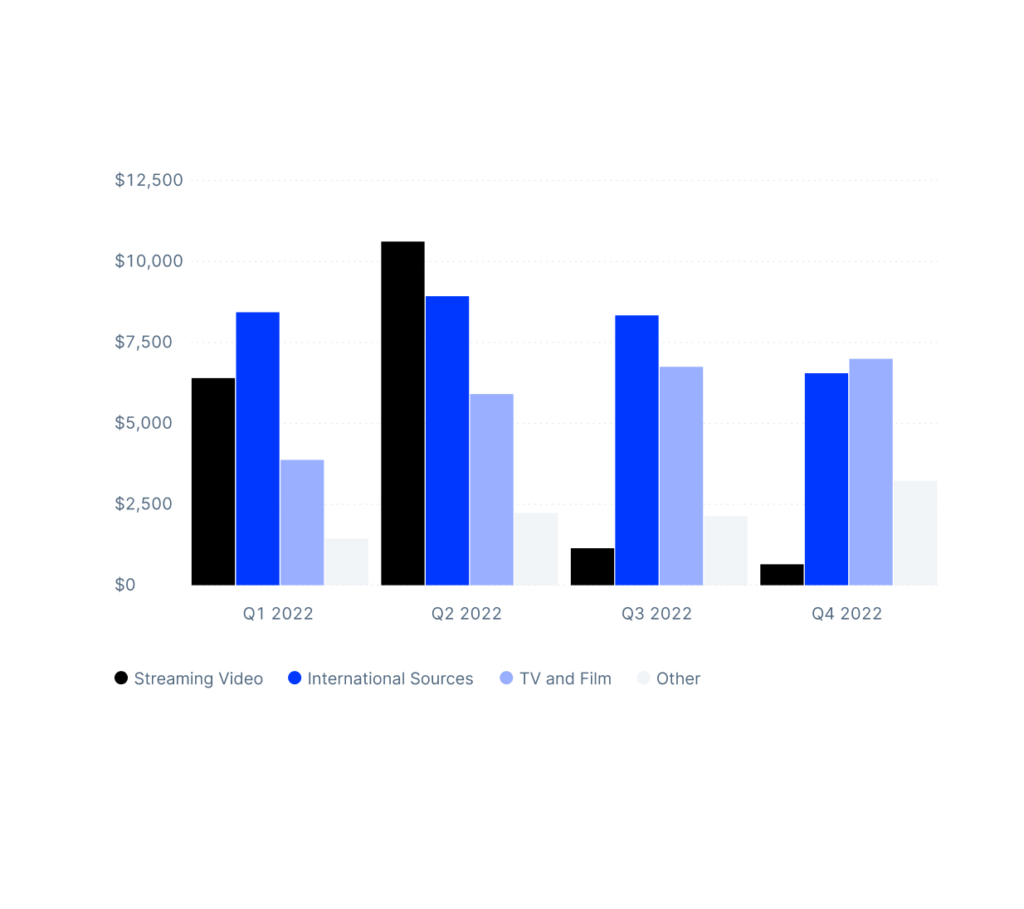

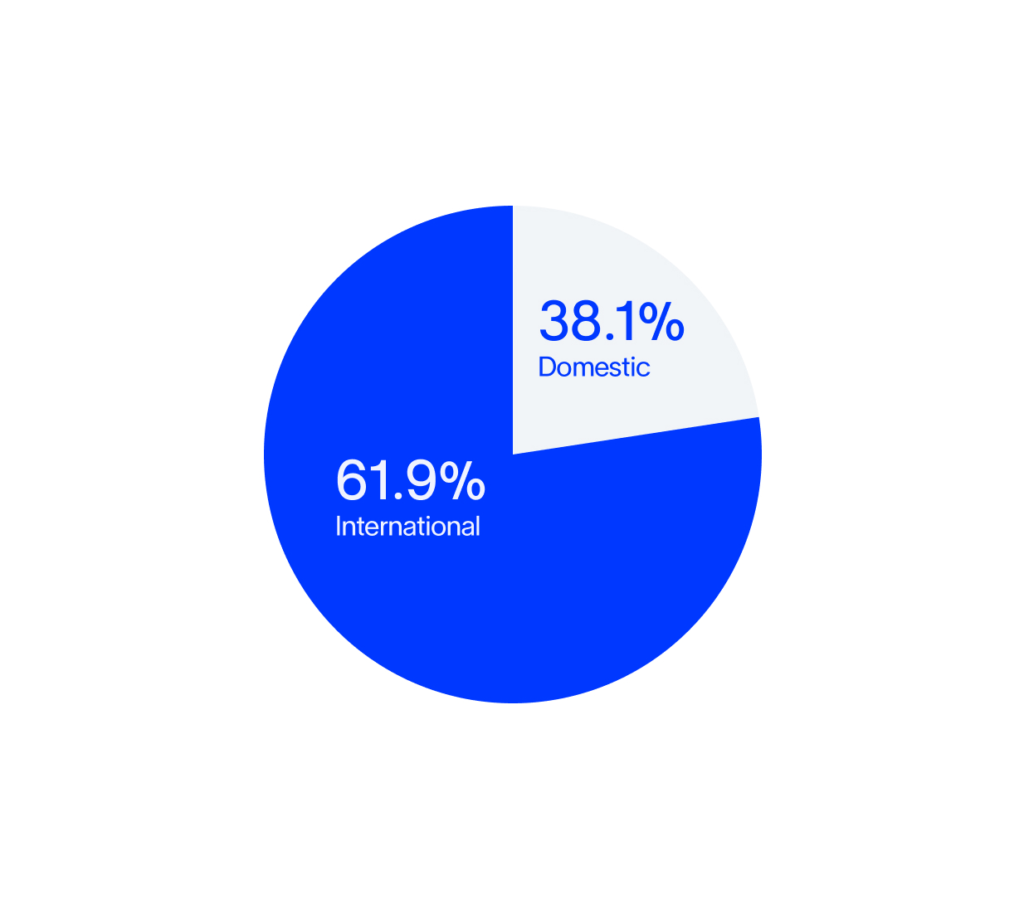

Potentially accumulate income from licensed usage of content across digital streaming platforms, broadcast TV, radio, and more.

Invest in traditionally uncorrelated assets

Because royalty payments are based on content consumption, performance is typically not correlated with stock or bonds.

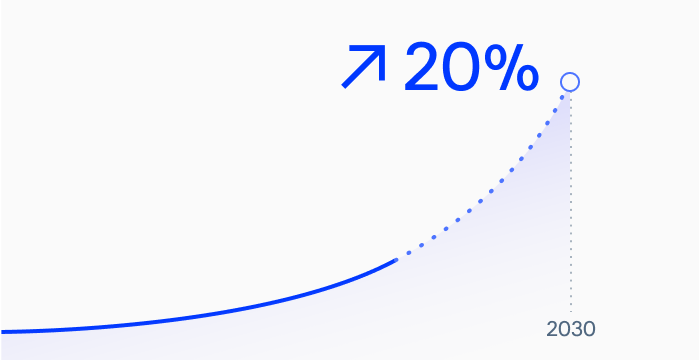

Tap into a growing market

The global streaming market is anticipated to grow by over 20% by 2030*, providing more opportunity for content consumption.

Source: Grand View Research, Inc. Apr 2023

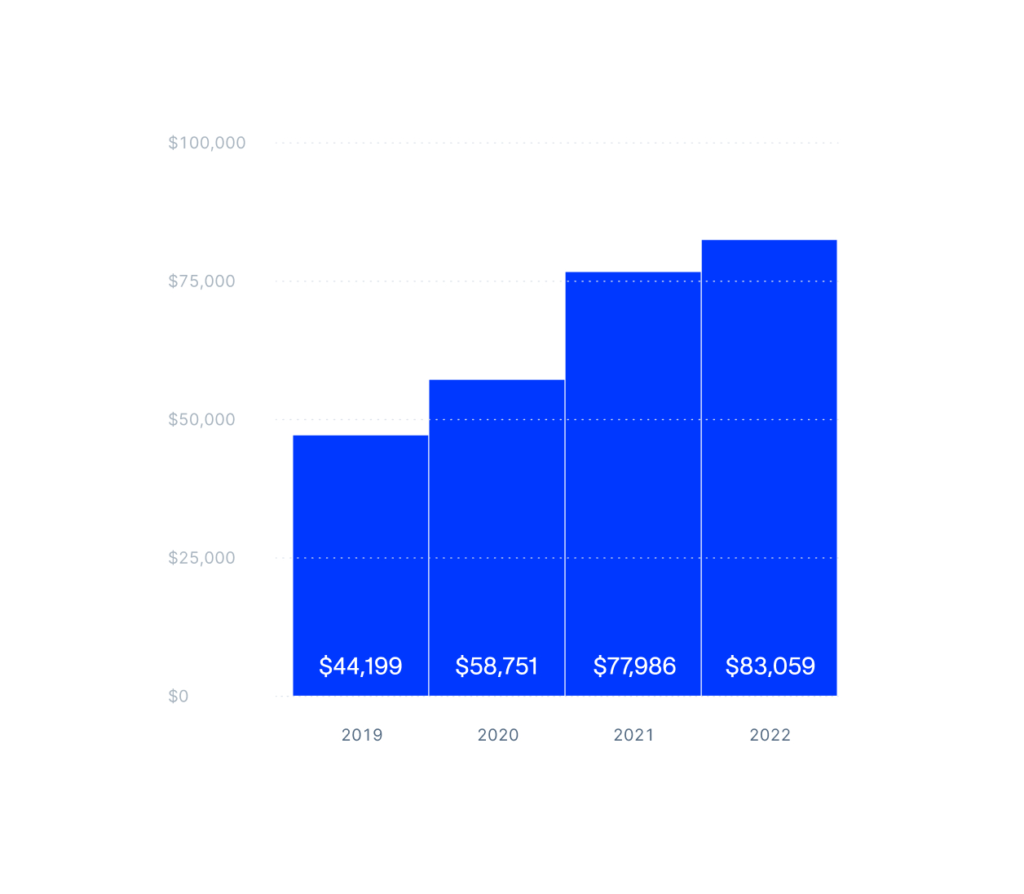

Explore our debut royalty asset

We’re launching royalties on Public with the exclusive Reg A+ IPO of Royalties: Shrek Franchise Original Music. As a shareholder, you’ll be eligible for income from the use of 768 original music tracks from the iconic Shrek film franchise.

Shrek Franchise Original Music

"Shrek" is a registered trademark of DreamWorks Animation LLC.

0

Original songs

$0K

Value at Reg A+ initial public offering

0%*

2022 dividend yield

*Royalties paid as of July 2023. Percentage calculated by dividing historical 12-month royalty earnings less 10% fees but including all taxes by offering amount of $889,700. Source: Royalty Exchange Inc. Past performance is no guarantee of future results. Dividends are not guaranteed and may fluctuate or not be paid at all.

Shrek Franchise Original Music

Shrek Franchise Original Music