It’s never too early to start saving for retirement, and the earlier you start the better. That’s because when you start young you’re able to take more chances since you’ll have more time to recover from the natural ebbs and flows of the market, and you’ll also have more time to grow your investment.

Know your goals

There are many factors to consider when planning to retire: your current age, your age when you hope to retire, your sources of income (both current and projected), how much you can reasonably invest in your retirement, your retirement living situation, all your savings accounts (both current and projected), and the health history of both yourself and your family. Keep important life events like divorce, deaths in the family, and children in mind, as well. Also, don’t just plan for the best; plan for the worst, too.

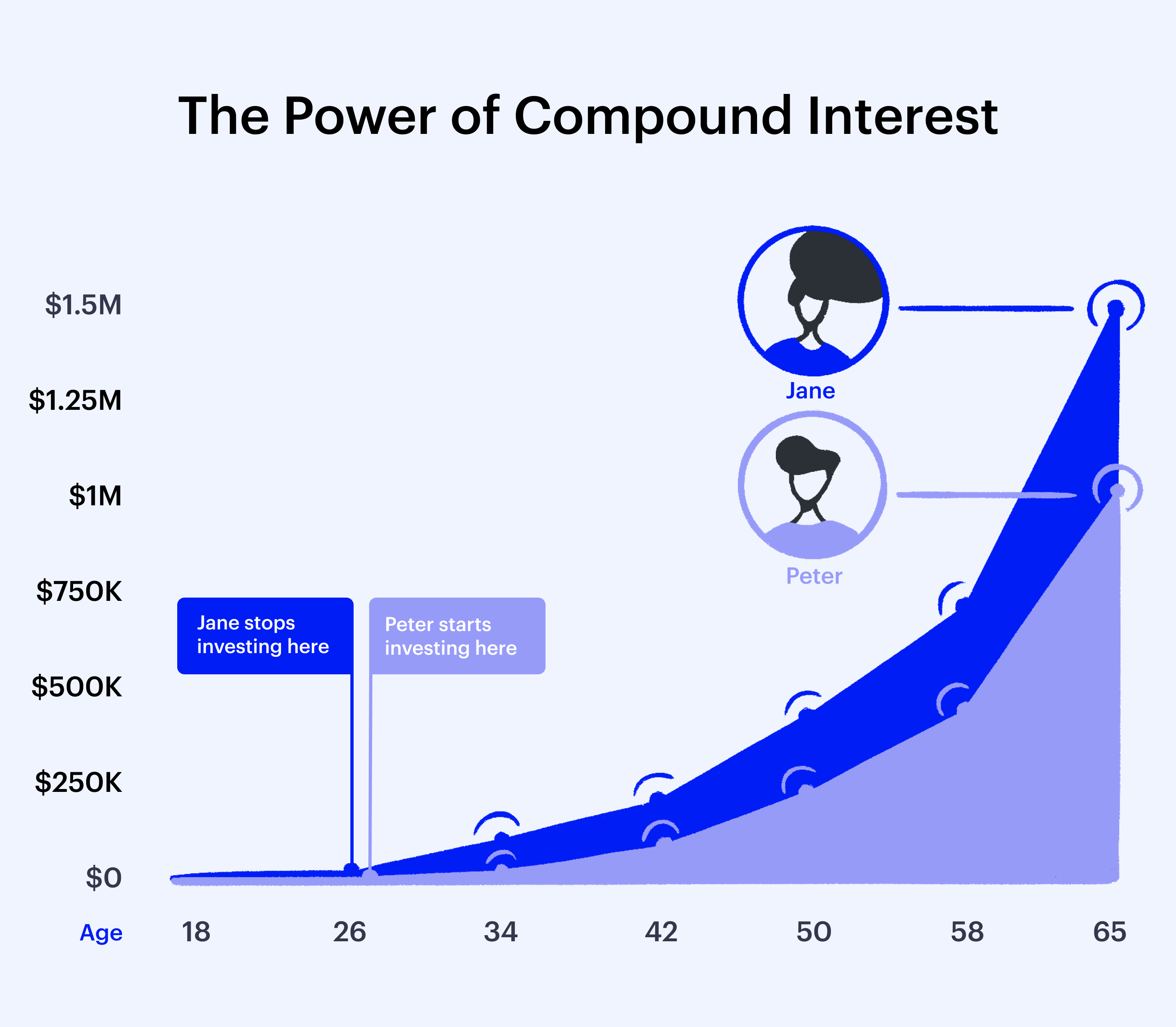

The power of compound interest

Compound interest is interest on interest. It’s when your money grows faster because you’re collecting interest on your principal as well as the interest you collect over time. And your savings will grow even more if you invest in the stock market or any other investment that has a greater return on investment.

Why invest now?

Thanks to compound interest, time is more important than money when it comes to planning for your retirement. That’s because the more time you have, the more you’ll earn based on historical investing trends. That’s even true if you stop adding money at a certain age as opposed to continuing to add money after having started to save later in life.

Here’s some math to help illustrate this point. If you save $2,500 a year from age 18 to 27, which is $22,500, and your rate of return is 10%, you’ll end up with $425,000 more by the time you reach 65 than if you had invested $2,500 a year from age 27 to 65, which is a total contribution of $97,500. That’s the power of compound interest.

What are the challenges of saving for retirement?

One of the biggest challenges of saving is finding the money to save. Many people live paycheck to paycheck, and having to set money aside for the future just further exasperates that struggle. But it’s nonetheless important to save what you can because no one else can save for you. There will be times when you may not have money to save and your options may be less plentiful but commit to saving nonetheless. Even if it’s just a little at a time.

Before you start investing

Before you start planning for the future you want to be able to survive the present.

Establish an emergency fund

Emergencies happen when you least expect them. That’s what makes them emergencies! So, be prepared. Work your way up to $1,000 that you never touch. Then, once you’ve taken care of debts that aren’t long-term loans, work toward establishing an emergency fund that’s three to five months worth of your living expenses.

Pay down your debt

Debt is a money suck, especially high-interest debt. So, take care of these black holes for money and then set a trajectory far, far away from racking up more debt. The less money you spend on paying off your creditors the more money you have to save for the future.

Set a budget

Plan your budget for the following month before the following month actually comes. That’s what it means to plan ahead. You can practice zero budgeting, which is where you account for every dollar until you have none left. You can also incorporate the 50/30/20 rule, which just means targeting to spend 50% on needs, 30% on wants, and 20% on savings.

Why start investing small?

Investing in small amounts has the benefit of building strong habits that continue over time. As your career advances and you are able to invest more, those habits will still hold. But remember, it’s time and not money that’s the most important factor to saving.

You can cultivate consistency by setting up automatic contributions through your bank, brokerage, or employer.

How to get started investing for retirement

Now that you’ve got your budget, emergency fund, and a willingness to invest, it’s time to get going.

Sign up for your employer’s 401(k)

Hopefully, your workplace offers a 401(k) plan with an employer match. If this is the case for you, take full advantage of that before you even pay off high-interest credit card debt because free money will only lead to more wealth later. Next, take care of any debts, and put any leftovers into a Roth IRA.

401(k) not an option? Consider a Roth IRA

If you don’t have access to a 401(k) at work then a Roth IRA is a great option. You’ll deposit your money from your paycheck after it’s already been taxed, but when the time to make withdrawals comes around you’ll be getting your money tax-free. If you arrange for automatic contributions, you’ll never forget to save and you’ll also get used to living with less.

There are many other benefits to opening a Roth IRA. To begin with, a Roth IRA can double as an emergency fund. Since your contributions are taxed, you can make your withdrawals tax free and without penalty at any time. And after your 59 1/2 and your account has been open for over five years, you can withdraw more than just your contributions.

In an attempt to be even more flexible, the IRS allows qualified withdrawals in the following scenarios:

- First-time home purchase (up to $10,000)

- Postsecondary education expenses

- Permanent disability

- Unreimbursed medical expenses that are greater than 10% of your adjusted gross income

- Back taxes

- Health insurance premiums during unemployment.

There are other benefits to a Roth IRA, as well. Unlike regular IRAs that cap contributions at 70 1/2, you can keep investing in your Roth IRA as long as you want. You can also bequeath your Roth IRA to your heirs, which means a tax-free income for their entire lifetime. And while there are rules in place that limit the amount high-earners can make in contributions to their Roth IRAs, those rules can be circumnavigated by making nondeductible contributions to a traditional IRA that’s then converted to a Roth IRA.

Set a budget

Ideally, you’ll contribute 15% to 20% of your monthly income to your retirement. If that’s hard to do, you might consider establishing budget goals and being more diligent when it comes to tracking where your money is going. Based on this, you might decide to opt for less expensive social habits, giving up vices (like drinking or smoking), and finding ways to curtail other forms of “leaky hose” spending.

Starting late?

Starting late is better than starting never. Luckily, there are changes in place to be more accommodating for investment late bloomers. Workers age 50 and up can contribute an extra $6,000 per year to their 401(k)s, and an extra $1,000 to their Roth IRA (although those numbers may change before you reach that age). Keep in mind, however, that the older you are the lower your risk tolerance will likely be.

Bottom line

The earlier you start saving for retirement, the better. Luckily, the practices that lead to good retirement savings are applicable to all parts of your life. If it looks tough to do, do what you can. That way you’ll be cultivating habits you can put to use when you can do more.