Table of Contents:

- How Do I Invest in Stocks?

- Step 1: Determine Your Investing Goals

- Step 2: Decide Where to Invest in Stocks

- Step 3: Pick Your Investing Strategy

- Step 4: Determine Your Investment Budget

- Step 5: Open an Investment Account

- Step 6: Choose the Right Stocks for You

- Step 7: Track Your Progress

- Frequently Asked Questions

Investing in the stock market offers a way to grow your money over time as you live your life, with the goal being that you will reap the rewards in the future. Still, when it comes to learning how to invest in the stock market, there can be a lot of confusion, especially for beginners.

You’ll come across some interesting terms along the way, and as you learn, your understanding will grow naturally. So, don’t worry if you’re not familiar with terms such as bear markets and bull vs. bear just yet. Like most things, there is a learning curve, so spending a little time researching will be worth the effort.

When it comes to investing, there are both risks and rewards, but like anything else, just getting familiar with the basics of investing in stocks can provide a good jumping-off point, reducing some of those risks. Today, with so many options available and the ability to do it yourself, there is no reason to wait.

Despite the myth that investing is only for the super wealthy, it isn’t. It just takes some time and a little money. For many of us, when we think about investing in the stock market, a variety of things may come to mind. Most will be scenes from movies that depict the frenzied stock market floor or heavy hitters getting filthy rich off one stock. The reality of how to play the stock market is very different.

Think about it this way, when you buy stock, you’re buying a small piece of a company with hopes that it will gain value over time, providing you with a healthy financial future.

As a DIY investor, you have a lot of choices, and there are some definite steps you can take to make the most of your money, and you can do it all as a novice. Researching the stock market is an excellent place to start.

Although the DIY route is for those who want total control over their investment options, this doesn’t mean you have to go it alone. There is a wealth of information available so you can get up to speed quickly and feel confident in making decisions. The benefit is that it allows you to choose low-cost investments and maintain control over those choices and your costs.

How Do I Invest in Stocks?

Although the world of finance is filled with financial gurus who seem to complicate the ideas and concepts surrounding the stock market and how to invest, don’t let it intimidate you. All it comes down to is putting your money in companies that are financially stable and monitoring them as necessary.

That being said, nothing beats being an educated investor, so before you start investing in stocks, let’s get familiar with the concept of the stock market and how stocks work.

When you hear people discuss the stock market, they are most likely referring to what is known as the Dow Jones Industrial Average (DJIA) or the Standard & Poor’s 500 (S&P500), which are the major indexes that show how the various companies that make up the stock market perform. However, as an investor, it’s essential to understand that the stock market is a place where regular people can buy and sell stocks, which, as we now know, are fractional pieces of the companies we buy ownership into.

Some of the terms to be familiar with include:

- Asset — the term used to describe anything that has monetary value. In the stock market, that would include stocks, bonds, and cash reserves which you can use to buy and sell in the market.

- Asset allocation — an investment strategy that takes into consideration some vital information such as age, risk tolerance, and investment goals to offer a well-balanced portfolio of stocks, bonds, and other investments to help you to reach your investment goals.

- Stocks — what companies issue to investors to grow their business by raising money. Investors purchase stocks to grow their money and get ahead of inflation.

- Bonds — one of three main investment assets used to invest in the stock market. They are loans to companies that provide a fixed rate of return to investors over time.

- ETFs — otherwise known as exchange-traded funds – are funds that can be traded as a group or bucket of assets, similar to how stocks are traded in the stock market.

- Yield — the annual rate of return of a bond or other financial assets.

- Bear market — when stock prices fall by 20% or more over a two-month period of time.

- Bull market — when stock prices rise 20% or more for at least a two-month period of time.

- IRA — an individual retirement account that allows a tax advantage in saving for retirement.

- A broker — also called a stockbroker – is a licensed person or investing company allowed to buy and sell through stock market exchanges.

- Financial planner — helps individuals to manage their money. They offer advice on retirement planning, investing, and monitoring their client’s financial life. They can be professionals or what is known as Robo-advisors, which are digital investment managers that can be utilized for assistance in making investments through your brokerage account as a DIY investor.

- Robo-Investor — an automated service that uses computer advanced software and algorithms to suggest and build investment portfolios online through a brokerage account.

- CFP — or certified financial planners – go through a rigorous certification process and must adhere to a strict ethical standard of practice and fiduciary standard that obligates them to create a financial plan with their client’s best interest in mind.

- Fiduciary — is a person or organization obligated to their client’s best interests and must invest in only those investments that suit their client’s goals. They are held to a high standard of trust, putting their clients first in order to avoid any conflicts of interest.

- Passive investing — is a hands-off approach that may utilize a Robo-investor to choose investments through algorithms with no human interaction. It focuses on long-term investment goals that require little monitoring.

- Fund — is money that is saved for a specific purpose. In investment terms, an example is mutual funds, which allow shareholders to invest in a portfolio of a variety of stocks and bonds.

- Mutual fund — a company that pools the money from investors and uses it to invest in securities such as stocks, bonds and short-term investments.

- Index fund — a category of mutual funds that attempts to perform the same way the S&P 500 index would.

- Market index — is a grouping of investments such as the S&P 500, which is made up of five-hundred stocks from the biggest companies in the US.

- Diversification — reduces your stock market investment risk by spreading your investments over a wide range of assets such as stocks, bonds, mutual funds, and cash reserves. Diversifying allows you to reduce your risk by not putting all your eggs in one basket.

- Compound interest — the interest earned on both the original deposit amount and the interest that that original amount earns. It’s one of the most powerful concepts in stock market investments.

Although these are just a few of the terms you’ll come across in your journey on how to get into the stock market, you will find them helpful in gaining an overall understanding that will come in handy as you continue to learn.

Steps to Start Investing in Stocks

For those who have not had experience in how to invest in the stock market, the process can feel overwhelming, so you’re going to want a guide. The steps aren’t difficult, so take them one at a time and learn everything you can along the way.

It’s important to note that the stock market does have fluctuations, so seek investment advice if you need it. There are no guarantees when it comes to how to invest in stocks but considering a few things can offer insights on how to play the stock market in a way that is comfortable for you. You’ll want to:

- Determine your investment goals

- Decide where you will invest and the tools you will utilize

- Choose an investment strategy

- Confirm your investment budget

- Set up an Investment account

- Choose stocks

- Track your investments’ progress

Step 1: Determine Your Investing Goals

Having stock market investment goals will help you decide where to invest and how to allocate those investments. You’ll want to identify tangible goals and allow time to make them a reality. They may include things like a plan to invest for retirement, setting up a college fund, or starting or expanding a business. Deciding what your goals are will help to clarify how to get started in stocks and set yourself up to achieve those targets.

Step 2: Decide Where to Invest in Stocks

To determine the best way to invest in stocks, you have to first figure out what you’re comfortable with. There are a few ways to go about it, including:

- A DIY approach where you’ll invest on your own

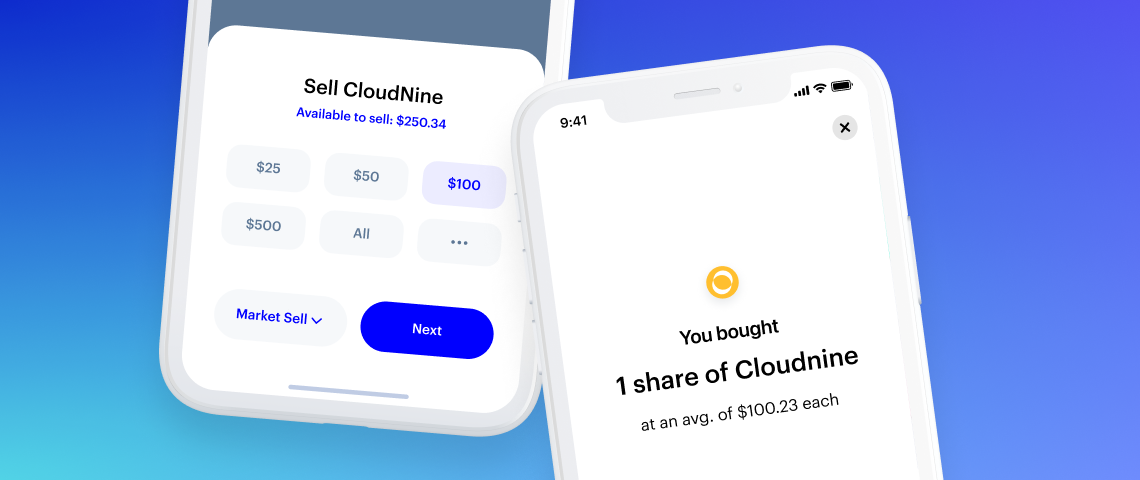

When it comes to DIY investing, there are so many options available. The big brokerage companies usually have a DIY option. Still, there are some great apps available as well, such as the Public app, which is a commission free option.

Whoever you invest with, you’ll want to check if any fees may be associated with the account. Most are low, making this the most cost-effective option. Although this is considered doing it yourself, remember that they all come with plenty of information that will be helpful.

- Investing in your employer’s 401K plan

This is one of the easiest ways to learn where to invest in stocks and teaches the basics in an easy-to-understand way. 401Ks usually don’t offer individual stocks but have diverse options such as mutual funds. When it comes to investing, the most proven methods can be summarized into doing just three things: Investing small amounts regularly, such as a percentage of your income from each paycheck, having a hands-off approach, and thinking long term.

- Investing through a full-service firm with an advisor.

If you’ve decided that having your investments handled for you is your best option, an advisor could be a good option. They can help you identify your goals, put a plan together for you, and choose the investments that will help you reach those goals.

They can help you to avoid decisions that may steer you away from your financial goals and keep you on track over the long term providing sound advice along the way.

There is no best option when it comes to where to invest in stocks, only the best option for you and your investing personality. However, each of these can offer easy options when it comes to reaching your goal.

Step 3: Pick Your Investing Strategy

Picking your investment strategy is an important step in how to invest money in stocks. The decisions you make will help to guide you through the process and give you the structure to stay with it over the long term.

Some investment strategies include:

- Passive strategy — when you buy and hold for the long term.

- Active strategy — when you buy and sell frequently, always trying to outperform the market.

- Growth investing — evaluating companies that have a growth track record over time and putting a portfolio together of about ten of those companies.

- Value investing — when you look for bargain stocks that may lead you to index or exchange-traded funds (ETFs).

Best Ways to Invest in Stocks

Investing offers a variety of opportunities and ways to learn how to play the stock market; you just need to know what they are. Since there is no one-size-fits-all solution, evaluating your investing style can assist you in making the right choices for you.

Your investment options can include one or all of the following:

- Individual stocks — are purchased in what is called shares. Buying one or more shares means you own a piece of that company. There are two ways to make money with stocks that include price appreciation and dividends that allow for unlimited growth potential.

- Equities — money that is invested in a company by purchasing in the stock market.

- Index funds — are exchange-traded funds (ETFs) and mutual funds that make up a portfolio that matches parts of financial markets like the Standard and Poor’s 500 index (S&P500) that offers a diversity of investments.

- Exchange-traded Funds (EFTs) — are traded on the stock exchange the same way stocks are traded, with prices fluctuating throughout the day.

- Mutual funds — are not traded on the stock exchange. They are traded only once after the stock market closes for the day.

Another term to know is called a call option, which is a financial contract that allows a buyer to purchase investments at a specific cost for a specified amount of time.

Step 4: Determine Your Investment Budget

When it comes to figuring out how to invest money in stocks, you want to first determine how much you can afford to invest. There are several things to consider that include:

- How much disposable income you have available. This is money that you don’t need to pay all your bills and day-to-day expenses.

- Your age. When you’re younger, you have more time to save for retirement, allowing you to invest small amounts of money on a regular basis. If you’ve started investing late, you’ll need to invest more money to meet your needs as you get closer to retirement.

- Your risk tolerance. In general, the rule is that the younger you are, the more risk you can take. But that doesn’t really say anything about you and what your comfort level is. If you aren’t comfortable with or stress out about your investments, choosing a less risky option for the long term can help you to sleep better at night.

- Your financial goals. Knowing your end game can help in making choices about your investment budget. Saving for retirement is different from a short-term goal of saving for a house, so having concrete goals will help to determine your budget.

Step 5: Open an Investment Account

So, now you’ve learned about the stock market, how to invest to suit your investment personality, and you’re ready to jump in. There are a lot of choices when choosing an investment account, and for anyone looking for DIY options, simpler is better.

- Investment apps have gained popularity due to the ease of getting started and the ability to check on investments and make trades on the go. Access to investment advice and the simplicity make investing a breeze.

- Traditional brokerage accounts offer a full-service option at a price. Depending on the type of account you open, it may be taxable, so do your homework when choosing this route.

- Employers’ 401K – is easy and offers a percentage of each paycheck to be invested regularly.

Opening an account is easy as 1-2-3

Once you have decided on goals, risk tolerance, available income, and have determined what type of account you want to open, it’s time to fill out an application!

- All you’ll need is some basic information along with your social security number and driver’s license number.

- Fund the account by transferring money from your bank account.

- Research investments.

- Give it time.

Step 6: Choose the Right Stocks for You

Only you can decide what types of investments are a good fit for you, but it’s worth looking into some of the most popular themes to see if you find anything interesting. Since we’ve covered how to get into stocks and you’ve evaluated the essential aspects of your investment personality, it’s time to research and dive into the stock market as an investor.

As we talked about, diversification is a way to have a well-rounded portfolio that can help you reach your financial goals. Adjusting your goals annually can help you to stay on track over the long haul.

Step 7: Track Your Progress

In order to know how your investments are doing, you’ll need to track them over time. Most likely, your brokerage account has tracking and graphs, but you can also use other methods as well, such as:

- Online tracking with Robo investors and apps.

- Personal finance software such as Quicken.

- DIY spreadsheets such as Excel

The way you track your investments can also depend on the choices you’ve made, and again, that will depend on what works for you. When you use investing apps, such as the Public app, you can simplify the process and your investments are just a click away.

Frequently Asked Questions

- Investing in stocks … good?

Investing in stocks can be a good financial decision and starting sooner is better.

- Is DIY investing a good idea if you’re just starting out?

There are plenty of investment tools that can help you to determine if that’s the right choice for you. Robo investors are a great option if you want some help choosing the right investments for you.

- Is it complicated to sign up for a brokerage account?

No, it’s actually very easy and can be done in just minutes.

- How does compound interest work?

Compound interest is why you can grow your money as an investor. To simplify, you can earn money on the money you invest over and above the percentage invested every month.

Investing is a way to increase your wealth by putting the money you earn to work for you. If you haven’t started, now is a great time to start. As you now know, the benefits of investing come over time by regularly putting a percentage of your income into your portfolio of investments and allowing them to grow.

Be sure to check out the Public app! It’s a great way to get started investing and the simplicity will offer all the tools you need right at your fingertips!