The landscape of investing continues to evolve, presenting both new challenges and opportunities. Fixed income investments, a cornerstone in the world of finance, remain as relevant as ever. But what does this mean for you in the current economic climate? Whether you’re a seasoned investor or just starting out, understanding the nuances of fixed income is essential in making informed decisions for your financial future. In this comprehensive guide, we’ll unravel the complexities of fixed income investments, helping you to navigate this crucial aspect of your portfolio with confidence.

A Complete Guide to Fixed Income for 2024

Table of Contents

What is Fixed Income?

In the realm of investing, fixed income plays a pivotal role, known for its potential to provide investors with a steady and predictable income. This term typically refers to investments where the returns are set at a predetermined rate and schedule. A quintessential example of this is bonds, whether issued by governments or corporations, where the issuer agrees to pay the investor interest at regular intervals and return the principal amount upon the bond’s maturity.

However, the scope of fixed income extends beyond just bonds. It includes a variety of assets such as treasury bills, municipal bonds, corporate bonds and certificates of deposit (CDs). Each of these fixed income forms comes with its own set of characteristics in terms of risk, maturity periods, and interest rates, accommodating a wide array of investment strategies and goals.

When comparing fixed income investments to other types like equities or stocks, a key difference emerges. Stocks represent ownership in a company and can offer higher returns, but they also carry a higher risk, especially in terms of market volatility. Fixed income, on the other hand, is often sought for its relative stability and predictability. That said, it’s important to recognize that fixed income investments are not entirely devoid of risk. Factors such as interest rate fluctuations, inflation, and the creditworthiness of the issuer can influence the performance of these investments.

For investors, understanding the nuances of fixed income is crucial for portfolio diversification and aligning investments with personal risk tolerance and financial goals. This guide aims to demystify the complexities surrounding fixed income, providing a foundational understanding that can aid in making informed investment decisions, including managing credit risk.

How Fixed Income Investments Work?

Fixed income investments are a cornerstone of the financial world, offering investors a way to earn returns through a relatively predictable income stream. These investments work by lending money to an issuer—such as a government or a corporation—in exchange for regular interest payments and the return of the principal amount at a future date, known as the maturity date. While fixed income investments are known for their relatively predictable income stream, it’s important to remember that all investments carry some level of risk. Investors should carefully consider their financial goals and risk tolerance before investing.

The Mechanics of Fixed Income Investments

-

Issuer and Investor Relationship:

When you buy a fixed income security, you’re essentially lending money to the issuer. In return, the issuer promises to pay back the principal amount on a predetermined date (maturity date) and make regular interest payments.

-

Interest Payments (Coupon Payments):

These are typically made annually or semi-annually and are based on the interest rate agreed upon at the time of issuance.

-

Maturity Date:

This is the date when the bond reaches its end life, and the issuer repays the face value to the bondholder.

-

Face Value (Par Value):

The face value is the amount that will be returned to the investor at maturity. It is also the basis on which the interest payments are calculated.

Real-World Example

To illustrate, let’s consider a real-world scenario. Suppose a local government issues a 5-year bond with a face value of $10,000 and an annual interest rate (coupon rate) of 3%. As an investor, if you purchase this bond, you are lending $10,000 to the local government. In return, you will receive annual interest payments of $300 (3% of $10,000) for the next five years. At the end of the fifth year, along with the final interest payment, you will also receive your initial $10,000 back.

Credit Rating of Fixed-Income Securities

Credit ratings play a crucial role in the fixed-income market, serving as a key indicator of the risk associated with lending money to issuers like governments and corporations. These ratings, provided by credit rating agencies, assess the creditworthiness of the issuer and the likelihood of them fulfilling their financial obligations.

Understanding Credit Ratings

-

Credit Rating Agencies: Organizations such as Moody’s, Standard & Poor’s, and Fitch Ratings specialize in analyzing the financial stability and credit history of bond issuers. They provide ratings that help investors understand the risk level of different fixed-income securities.

-

Rating Scales: Ratings typically range from ‘AAA’ or ‘Aaa’ (highest quality, lowest credit risk) down to ‘C’ or ‘D’ (highly vulnerable to non-payment, or already in default). The scale includes gradations (e.g., AA+, AA, AA-) to indicate slight variations in risk within these broad categories.

-

Factors Influencing Credit Ratings: Agencies consider various factors, including the issuer’s financial health, revenue streams, economic environment, political stability, and historical debt repayment performance.

Impact on Investment Decisions

-

Risk Assessment: Higher-rated bonds (e.g., AAA) are generally considered safer but offer lower yields. Conversely, lower-rated bonds (e.g., BB) carry higher risk but potentially offer higher yields to compensate for this risk.

-

Yield and Price Correlation: There’s often an inverse relationship between a bond’s credit rating and its yield. Higher credit risk can lead to higher yields, as investors demand greater compensation for taking on more risk.

-

Market Dynamics: Changes in an issuer’s credit rating can significantly impact the market value of their bonds. An upgrade can increase bond prices, while a downgrade can decrease them.

Real-World Implications

Consider, for instance, a corporate bond issued by a company with an ‘A’ rating, signifying a strong capacity to meet financial commitments but somewhat susceptible to adverse economic conditions. An investor in this bond might expect a relatively safe investment with moderate returns. However, if the company’s situation deteriorates and its rating is downgraded to ‘BBB’, the perceived risk increases, potentially leading to lower bond prices and higher yields for new investors.

Understanding credit ratings is essential for fixed-income investors, as it helps in making informed decisions about the risk-return profile of their investments.

Fixed Rate vs. Variable Rate Bonds

When it comes to bond investments, one of the fundamental distinctions lies in the type of interest rate they offer: fixed rate or variable rate. Both types have their own set of characteristics, benefits, and risks, which are important to consider based on individual investment goals and market conditions.

Fixed Rate Bonds

Fixed rate bonds are characterized by a constant interest rate throughout the bond’s life. This rate is set at the time of issuance and does not change, regardless of fluctuations in the market interest rates.

-

Predictability: They offer a predictable income stream, making them attractive to investors who prefer stability and certainty in their interest earnings.

-

Interest Rate Risk: However, they are susceptible to interest rate risk. If market rates rise above the bond’s fixed rate, the bond may lose value.

Variable Rate Bonds (Floating Rate Bonds)

Variable rate bonds, also known as floating rate bonds, have an interest rate that adjusts periodically, typically in relation to a benchmark rate like the LIBOR or a government bond rate.

-

Adjustability: The key advantage is their adjustability to changing interest rates, which can protect investors from interest rate risk.

-

Income Variability: On the downside, the income from these bonds can fluctuate, making them less predictable compared to fixed rate bonds.

Making the Choice

Choosing between fixed and variable rate bonds depends on several factors:

-

Interest Rate Outlook: If interest rates are expected to rise, variable rate bonds might be more appealing. Conversely, in a declining rate environment, fixed rate bonds could be more beneficial.

-

Risk Tolerance: Investors who prefer stable returns might lean towards fixed rate bonds, while those willing to accept variability in returns for potentially higher income might opt for variable rate bonds.

-

Investment Horizon: The length of time you plan to hold the bond can also influence the choice. A longer investment horizon might align better with fixed rate bonds, while a shorter term might benefit from the flexibility of variable rate bonds.

Real-World Example

Imagine an investor choosing between a fixed rate bond with a 5% annual coupon and a variable rate bond with a rate set at 1% above the current LIBOR rate. If the LIBOR rate increases significantly over the bond’s term, the variable rate bond could offer higher returns. However, if the LIBOR rate remains stable or decreases, the fixed rate bond would provide a more consistent and potentially higher income.

This comparison underscores the importance of understanding both types of bonds and evaluating them in the context of your own investment strategy and market conditions.

Types of Fixed Income Securities

Fixed income securities come in a variety of forms, each offering different risk profiles, returns, and structures. Understanding the types of fixed income securities is crucial for investors looking to diversify their portfolios and align investments with their financial goals.

1. Government Bonds

Government bonds are issued by national governments and are generally considered one of the safest fixed income securities due to the low default risk.

-

Treasury Bonds: Treasury Bonds are long-term securities issued by the U.S. Treasury, with maturities ranging from 10 to 30 years.

-

Treasury Notes: Treasury Notes are medium-term securities with maturities of 2 to 10 years.

-

Treasury Bills: Treasury Bills are short-term securities with maturities ranging from a few days to 52 weeks.

2. Municipal Bonds

Issued by state, local, or municipal governments, these bonds often offer tax advantages, such as exemption from federal taxes and, in some cases, state and local taxes.

-

General Obligation Bonds: Backed by the full faith and credit of the issuing municipality.

-

Revenue Bonds: Funded by specific revenue sources, such as tolls or service fees.

3. Corporate Bonds

Corporations issue these corporate bonds to raise capital. They typically offer higher yields compared to government bonds but come with higher credit risk.

-

Investment-Grade Bonds: Issued by financially stable companies, these bonds have a lower risk of default.

-

High-Yield Bonds (Junk Bonds): Offered by companies with lower credit ratings, they carry higher risk but provide higher yields.

4. Asset-Backed Securities

These are bonds backed by financial assets, such as loans, leases, or receivables.

-

Mortgage-Backed Securities (MBS): Secured by mortgage loans.

-

Collateralized Debt Obligations (CDOs): Pooled various types of debt, including mortgage-backed securities.

5. Certificates of Deposit (CDs)

Offered by banks, CDs are time deposits with fixed terms and interest rates, typically ranging from a few months to several years.

6. International Bonds

These include bonds issued by foreign governments or corporations, which can be denominated in various currencies.

-

Eurobonds: Bonds issued in a currency other than the issuer’s home currency.

-

Foreign Bonds: Issued in the local currency of the country where they are marketed.

Each type of fixed income security comes with its own set of characteristics, risks, and benefits. Investors should consider factors like credit risk, interest rate risk, and liquidity when choosing the right type of fixed income investment to meet their objectives.

Pros and Cons of Fixed Income Investments

| Pros | Cons |

|---|---|

| Predictable Income Stream: Regular, predetermined interest payments provide a steady income. | Interest Rate Risk: The value of fixed income securities can decrease if interest rates rise. |

| Lower Risk Than Equities: Generally less volatile compared to stocks, offering a safer investment option. | Lower Return Potential: Typically offer lower returns than equities, especially in low-interest environments. |

| Diversification: Can help balance a portfolio, reducing overall risk. | Credit Risk: The risk of issuer default can vary, especially with corporate bonds. |

| Capital Preservation: May be a fit for conservative investors focused on preserving capital. | Inflation Risk: Fixed payments may lose purchasing power over time due to inflation. |

| Tax Advantages (specific types): Certain bonds, like municipal bonds, may offer tax benefits. | Liquidity Risk: Some fixed income securities may be harder to sell quickly at a fair price. |

| Fixed Maturity: Typically a clear timeline for return of principal investment. | Reinvestment Risk: The risk of having to reinvest returns at a lower rate in a declining interest rate environment. |

Impact of Inflation on Fixed Income Securities

Inflation is a key economic factor that could have a profound impact on fixed income securities. It represents the rate at which the general level of prices for goods and services is rising, subsequently eroding the purchasing power of money. This erosion is particularly relevant for fixed income investors, as it affects both the income generated from these investments and their overall value.

Inflation and Fixed Income Returns

-

Reduced Purchasing Power: The fixed payments from bonds and other similar securities may become less valuable over time if inflation rises. For instance, a 5% annual return on a bond might seem attractive, but if inflation is at 3%, the real return is effectively reduced to 2%.

-

Interest Rates and Bond Prices: Inflation often leads to higher interest rates, which in turn can cause the market value of existing bonds to fall. This is because new bonds are likely to be issued with higher yields to keep pace with inflation, making older, lower-yielding bonds less attractive.

Strategies to Mitigate Inflation Risk

-

Inflation-Linked Bonds: These bonds, such as Treasury Inflation-Protected Securities (TIPS) in the U.S., have their principal and interest payments adjusted to account for inflation, as measured by consumer price indices.

-

Floating-Rate Notes: Unlike fixed-rate bonds, these securities offer interest payments that adjust in line with prevailing interest rates, which often rise alongside inflation.

-

Shorter Duration Bonds: Investing in bonds with shorter maturities may reduce exposure to inflation risk, as they allow for quicker reinvestment at potentially higher rates that may keep pace with inflation.

Real-World Implications

Consider an investor holding long-term fixed-rate bonds during a period of rising inflation. As inflation increases, the fixed interest payments from these bonds might not keep up with the increased cost of living. Consequently, the investor could see a decrease in the real income generated from their investment. To counter this, incorporating inflation-protected or floating-rate securities could provide a hedge against inflation.

Understanding the impact of inflation on fixed income securities is vital for investors, as it helps in making informed decisions and adjusting strategies to protect the real value of their investments. However, please remember that all investments carry some level of risk.

How to Invest in Fixed Income

Investing in fixed income securities can be a strategic move for diversifying your investment portfolio and securing a stable income stream. Whether you’re new to investing or an experienced player in the financial markets, getting started with fixed income investments is straightforward, especially with the right tools and platforms at your disposal. Here, we also introduce how Public.com can streamline this process for you.

Steps to Invest in Fixed Income

-

Research and Choose Your Fixed Income Investments: Start by researching different types of fixed income securities, such as government bonds, corporate bonds, or municipal bonds, based on your risk tolerance and investment goals.

-

Consider Diversification: Diversifying your investments across various types of bonds and maturities can help manage risk.

-

Decide on the Investment Method: You can invest directly in individual bonds, bond mutual funds, or bond ETFs.

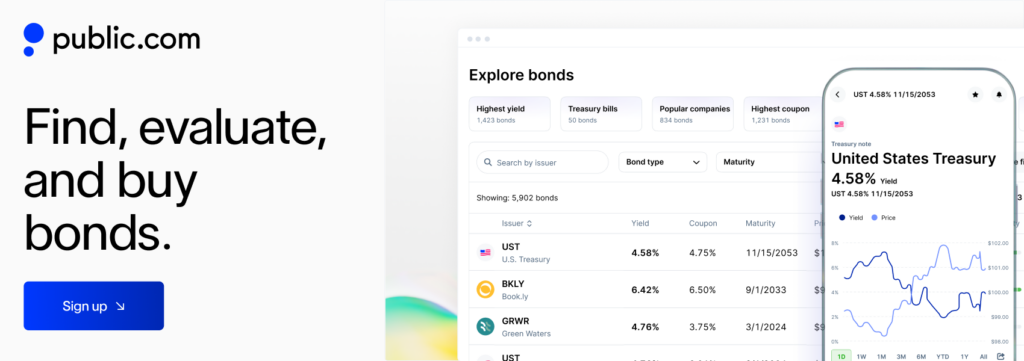

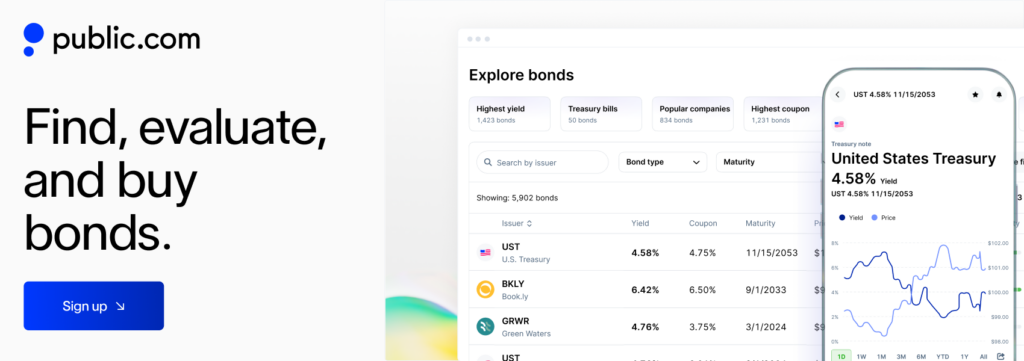

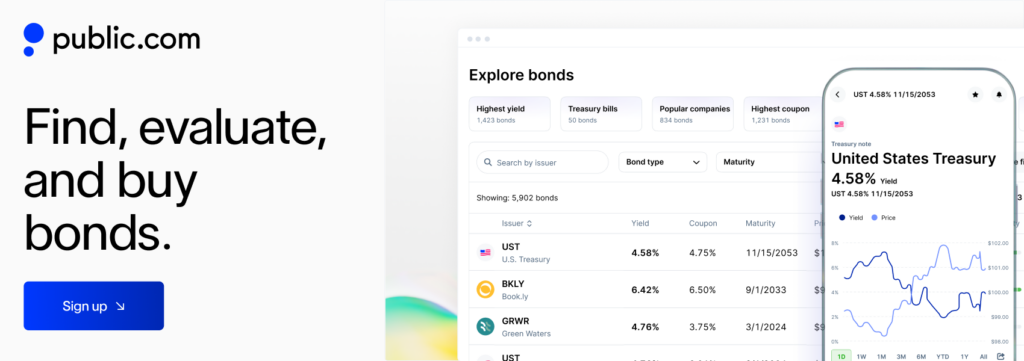

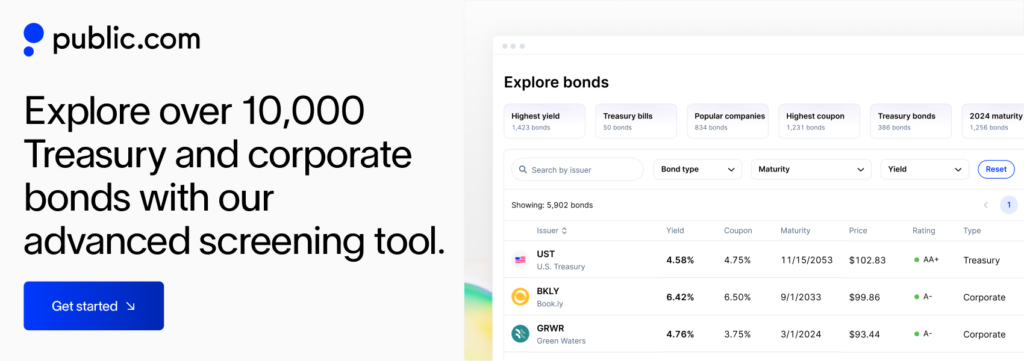

Public.com: Enhancing Your Fixed Income Investment Strategy

Public.com has gained recognition as a notable investment platform, known for its blend of technological innovation and intuitive user experience. This combination delivers a streamlined investment experience tailored to meet diverse investor needs.

-

Advanced Bond Screener: With Public.com’s advanced bond screener, investors can easily navigate the complex world of bonds. The tool enables efficient searching based on key metrics like yield, maturity, and credit rating, facilitating smarter investment choices in fixed income securities.

-

User-Friendly Mobile App: The Public.com mobile app redefines investment management convenience. Its sleek, easy-to-navigate interface allows for seamless diversification across stocks, bonds, treasury bills, ETFs, cryptocurrencies, and other asset classes. Stay on top of your portfolio and market trends with real-time updates and insights.

-

Rich Educational Content: Public.com is committed to investor education, offering a wealth of resources that demystify the complexities of fixed income investments. These resources empower investors with the knowledge to make well-informed decisions.

-

Interactive Investor Community: The platform fosters a dynamic community of investors, encouraging knowledge sharing and collaborative learning. Through the app, you can connect, exchange ideas, and gain insights from a diverse group of investors.

Public.com’s approach to fixed income investment simplifies the process while equipping investors with critical tools and resources. The platform is designed not just to facilitate transactions but to enhance the overall investment journey, combining ease of use with educational and social elements to support informed decision-making.